It is one of the subsidiaries of Azm Holding Company for the purpose of developing digital products and services that support the company's solutions at the beginning. The company's services have received wide acceptance from the largest financial authorities in the Kingdom and the company is still developing products and services aimed at enabling digitization in all sectors

There is a need to create financial services linked to banks and other relevant parties to well respond to the needs of the user and are ready to keep pace with future developments

The Main Objectives we seek to achieve in Azm Digital

Building No. (23), Laysen Valley , King Khalid Rd-Riyadh , Kingdom of Saudi Arabia

Telephone: +966 115062562

Abdoun - Al-Masarrah St. Amman, Jordan

Telephone: +962 659 31837

Disclaimer:

We do not provide financing services

An integrated system specialized in managing group accounts for a group of invoices and operators To handle collection, distribution, Fess calculations and settlements systems In the various technical platforms to keep abreast of the development in new technical business models

bills by biller.

by the end customer.

for financial operations by the system.

collection through B2B System.

The crowdfunding platform is a preventive project for citizens who are unable to pay certain expenses It aims to engage the community (individuals / organizations) to lend a helping hand through a unified online platform It connects the donor and the need through an effective working mechanism that achieves transparency, accuracy and professionalism in providing support.

An online platform to enable finance providers to manage their financing products and study funding requests electronically To enable the customer to apply for a new financing request, inquire about it, and pay it back In order to fully automate the financing process, develop and provide convenient, unconventional services to the customer

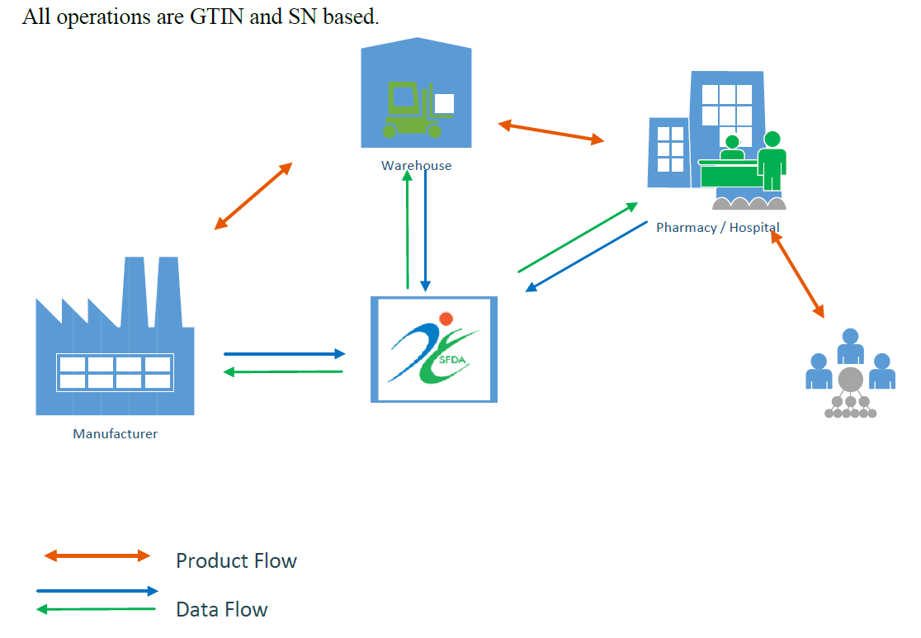

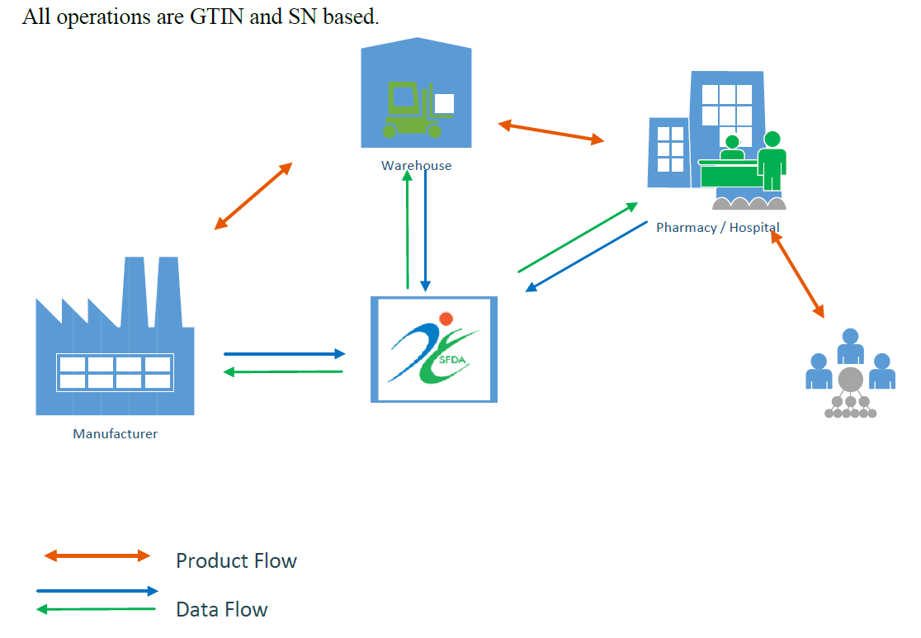

The Saudi Food & Drug Authority initiated Drug Track and Trace System as one of its plans to contribute to the National Transformation Program 2020. This program aims to achieve the kingdom’s Vision 2030 by adopting a new technology for tracking all human registered drugs manufactured in Saudi Arabia or imported from abroad. Drug Track and Trace System enhances Saudi Food & Drug Authority’s role in protecting society and guaranteeing the safety of all drugs by knowing their origin starting from manufacturing phase until consumption RSDconnect can provide your business with a degree of flexibility and speed for rapid growth. By delegating IT infrastructure responsibilities to (AZM), you can maintain your attention to your business through technical details and focus on providing unique benefits to your customers. With RSDconnect, you need minimal IT staff anywhere, thus reducing the need to build and maintain your IT infrastructure while ensuring that your concerns about service reliability, performance, security, and data sovereignty are properly addressed.

For more details, please visit the following link for direct registration with the system

https://rsdconnect.com

Stakeholders will receive a rapid exchange of information between their internal system and the Drug Tracking and Tracking System (DTTS) of SFDA according to the latest technical and professional standards, in accordance with the standards of the authority, and within the rules and regulations in force in the Kingdom of Saudi Arabia.

Ensures cost-effectiveness. The SaaS template removes post-deployment expenditures, while minimizing maintenance costs and ongoing updates, to the lowest possible cost

High level of customer support. Whether you contact us by phone or email, you get the full support of highly skilled professionals.

A ready web platform that is used as an integrated process for the process of reporting operations linked directly to a RSD track and trace system to directly report to it without integrating any backend system

An electronic platform that links the applicant to the financier (individual or corporate investors) Through the crowdfunding system of projects as a way to obtain small sums of money from a large group With the aim of diversifying financing methods using modern technologies

An agreement has been signed between the Ministry of Justice and the Saudi Azm and Thiqah companies to implement a project to establish and develop Nafith platform in cooperation with the Ministry of Trade and Investment for being the legislator of the commercial paper system. This ensures ease of operations, reliability, speed of implementation and judgment in line with the digital transformation plan 2020 and the Kingdom's 2030 vision. In the first stage of the platform, Nafith platform focuses on the mechanics associated with a promissory notes processing.

For more details, please visit the following link

https://nafith.sa/

The Saudi Food & Drug Authority initiated Drug Track and Trace System as one of its plans to contribute to the National Transformation Program 2020. This program aims to achieve the kingdom’s Vision 2030 by adopting a new technology for tracking all human registered drugs manufactured in Saudi Arabia or imported from abroad. Drug Track and Trace System enhances Saudi Food & Drug Authority’s role in protecting society and guaranteeing the safety of all drugs by knowing their origin starting from manufacturing phase until consumption

For more details, please visit the following link for direct registration with the system

https://rsdconnect.com

- Monitoring the full supply chain operations. - Guaranteeing that all sold or consumed drugs are genuine. - Reliable statistics about targeted medication for counterfeit. - Reliable statistics about source of selling counterfeit medication.

- Decrease the time consumed to provide Reliable data. - Easy platform for patient to know medication information via smartphones. - Support for the best use of products and reduce waste.

- Real time stop of recalled medications or with warnings. - Enabling the consumer to check the safety of a drug and report any side effects.

The General Authority of Endowments launched the "Waqfy" platform as one of the initiatives of the digital transformation of the authority to activate societal participation in the support of endowments and the non-profit sector and provide secure electronic payment options via the platform, and enables the donor to participate fully or partially in supporting projects and financing them digitally, and the launch of the platform is consistent with the directions The General Authority of Endowments, to achieve its mission to promote the endowment sector and to enhance the achievement of the goals of the Kingdom's Vision 2030 to achieve financial sustainability for the non-profit sector The platform offers through its website a package of endowment and development projects and projects for non-profit entities, so that different social groups and donors can contribute to development, in response to sustainable development needs and priorities.

For more details, please visit the following link

https://www.waqfy.sa/Promote community participation by providing innovative endowment and development products Participation of all social groups in supporting endowment and development projects

Offering a secure platform based on transparency of support and measuring its impact Facilitating grant operations for those wishing to contribute according to a stimulating regulatory environment

Strengthening the role of endowments in development and social solidarity Achieving financial sustainability for the non-profit sector and meeting development needs

Contracts.sa (عقود) is designed to facilitate and streamline the contract creation, review, and digital signature process. This provides a more compact means of storage, universal access for retrieval, and higher levels of data security and privacy

For more details, please visit the following link

https://contracts.sa/

Unify and enhance the E2E customer journey for Contracts and EPN

Create and manage the contracts electronically with the knowledge of both parties

Reducing paper based court cases and the number of signatures objections.

Enhancing the legal and financial workflow and procedures to become fully electronic.

Contribut to achieving the goals of the Kingdom's Vision.

Fill the required data and upload the file to be signed (Id, Name, region, mobile number).

Send SMS notification to the signer with the document details.

Review all request details to approve/ disapprove the signiture request.

- Collecting the KYC data and Sending Certificate creation request via high security and encryption protocol and create the signiture. - Digitaly sign the document and share the signed documents to the signature requester

Sign in through Absher SSO, Using Absher credentials and Absher OTP to confirm signer approval using Azm HA IAM solution with both TCC and Elm, soon to be with finger print as well

Fill the required data and upload the file to be signed (Id, Name, region, mobile number)

Send SMS notification to the signer with the document details.

Review all request details to approve/ disapprove the signiture request.

- Collecting the KYC data and Sending Certificate creation request via high security and encryption protocol and create the signiture. - Digitaly sign the document and share the signed documents to the signature requester

Sign in through Absher SSO, Using Absher credentials and Absher OTP to confirm signer approval using Azm HA IAM solution with both TCC and Elm, soon to be with finger print as well

E-Wallets... Toward a cashless community The Wallet Management System is a comprehensive, fully featured, and fully supported solution that automates every aspect of your money services and allows you to confidently offer your customers a full range of services such as utility bill payment, local and international money transfer, cashless transactions, paying friends or family, buying goods, branchless banking, and much more. e-Wallets are becoming the preferred payment option as they are a secure and convenient platform for all payment needs.

Is a cloud-based engine used to automate onboarding from application to approval using AI and machine learning methods for KYB and KYC to verify the business legal data and authorized identities to verify the customer details and identity in addition to integrating with the governmental services for acquiring all data electronically

An AML and screening system is a set of tools to detect and prevent money laundering activities. It includes features such as customer identity verification, risk-based assessment, watch list screening, transaction monitoring, reporting, record-keeping, flexible rule-engine, user-friendly interface and various reporting and visualization options.